Energy Infrastructure Opportunity Set

The growing urgency for energy transition, security, and resilience solutions has become ever apparent, presenting a strong opportunity set in the global marketplace.

Fortescue Capital looks for projects, development platforms, companies, and technologies benefiting from long-term secular demand, innovation, and supportive regulatory frameworks.

Market Demand Drivers

To meet surging global power demand while mitigating environmental impact, there is a critical need to accelerate the adoption of energy infrastructure and technology solutions.

Key market demand drivers supporting the investment thesis include:

- Population growth and urbanization

- Electrification of end-use sectors

- Replacement of aging infrastructure

- Technological innovation digitalization

- Energy security and resilience

- Input cost declines

- Decarbonization and climate goals

- Growth in green molecules

- Policy and regulation

- Private investment momentum

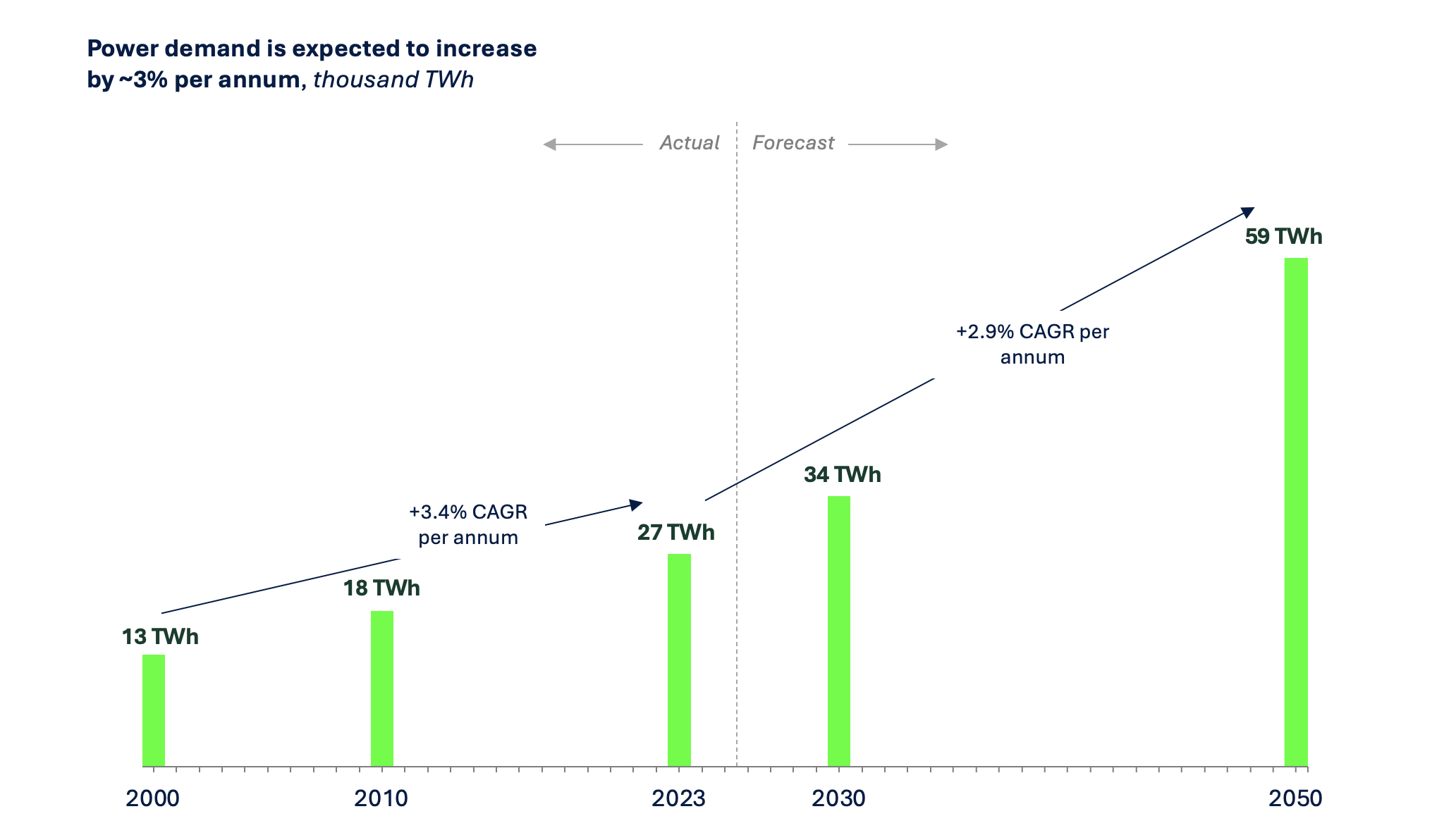

Rise in the global demand for power

Global demand for power is accelerating and projected to more than double the 2023 level by 2050, from 27,000 terawatt-hours to ~60,000 terawatt-hours.

This is largely due to:

- The growth in emerging markets’ energy needs

- Rising living standards

- Electrification across the economy

- Growing investment in artificial intelligence

The decarbonization of hard-to-abate sectors

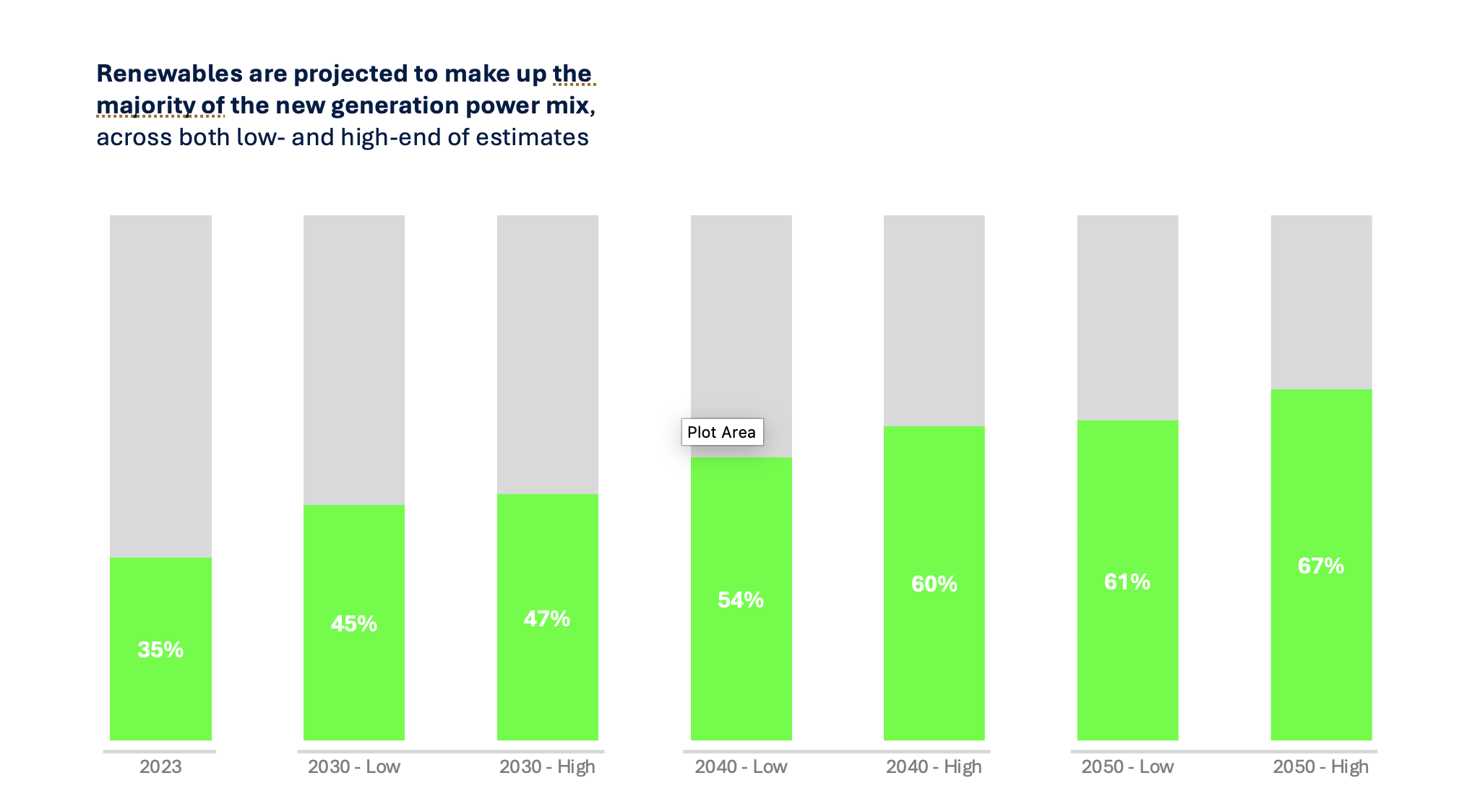

Renewables are a critical part of the energy ecosystem

Renewables and energy storage technologies represent cost-competitive decarbonization solutions. Costs have decreased ~85% since 2010, driven by increasingly mature robust supply chains, efficiencies, and public policy.

Solar and wind power are expected to see very strong growth in the next two decades - nearly threefold by 2030 and more than ninefold by 2050, compared with 2023 levels. This means that the share of renewable energy in the power mix could more than double in the next 20 years.

The role of battery storage and critical materials

Battery storage and critical materials are essential to the energy transition.

Critical materials, most notably copper, lithium, cobalt, and nickel, are under scaling pressure as batteries and electrification drive growth, with the energy storage market expected to have compound annual growth rate of 14.7% in gigawatt-hours from 2025 to 2035.

It is estimated that annual additions of global energy storage will reach 220GW/972GWh in 2035 to support the need for reliability, flexible capacity, and grid stability solutions.

Green Hydrogen and Ammonia

Green hydrogen and green ammonia will play a critical role in the decarbonization of hard-to-abate sectors such as iron and steel making, shipping, aviation, heavy-load transportation, and building materials.

Fortescue Capital remains committed to its parent’s longer-term green molecule ambitions. In the near term, the firm is prioritizing green electron investments while simultaneously buying strategic optionality ahead of cost compression and downstream price differentiation.